Yesterday's fast fall from the high of 5190 to 5042 made all difference in the Elliott wave counting and gives a perspective that wave five was not over at 5124.40. Only alternative counting is to think of the move from 4995 - 5124.40 - 5016 - 5144.35 - 5048 - 5190 as an ending triangle. [though not that comfortable in this labeling] Now the a-b-c correction is in progress. The angle of fall from 5190 to 5042 is so steep, which is normally observed in the first leg of the correction, the 'A'. Since the time taken for this fall was only a day, we may expect a more grinding 'B' followed by 'C'. Since this is expected to be the second wave, it may also retrace quite a bit of wave 1 which is 5190-4770 = 420 points. So far we have done 148 points.

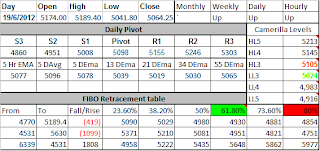

Nifty Pivot table:

Since the labeling is not clear, have removed 5 min chart from the post.

Nifty Elliott wave analysis of hourly chart:

Nifty daily Heikin Ashi chart:

Nifty hourly Heikin Ashi chart:

Nifty 5 min Heikin Ashi chart:

Nifty Pivot table:

Since the labeling is not clear, have removed 5 min chart from the post.

Nifty Elliott wave analysis of hourly chart:

Nifty daily Heikin Ashi chart:

Nifty hourly Heikin Ashi chart:

Nifty 5 min Heikin Ashi chart:

No comments:

Post a Comment