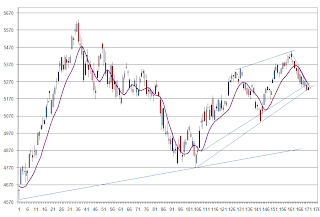

Nifty which was supposed to complete the wave 4 or wave 'd' slightly lower. However as per the Elliott Wave guidelines, it is still permittable to move anywhere between 66% to 81%. In our case wave 'd' appear to have moved close to 73.53%. Wave 'e' of this diagonal triangle may move somewhere near 5200 or upto 5190 range. A decisive move beyond the triangle boundary on the upside will confirm the labeling. This may happen either today or Monday. Till we are proved wrong, we shall continue with this wave labeling.

Hourly Elliott wave labeling :

One very interesting observation of the current market movement in the recent correction is that, everytime market tried to move near the 5 day SMA it faced resistance and turned down. So this can also be viewed if market moves above 5 day SMA and closes above it, it can be confirmed that market has reveresed for the short term.

Nifty Daily chart with 5 SMA:

As usual let us observe the market and take clues from the 'NOW'.

Hourly Elliott wave labeling :

One very interesting observation of the current market movement in the recent correction is that, everytime market tried to move near the 5 day SMA it faced resistance and turned down. So this can also be viewed if market moves above 5 day SMA and closes above it, it can be confirmed that market has reveresed for the short term.

Nifty Daily chart with 5 SMA:

As usual let us observe the market and take clues from the 'NOW'.

No comments:

Post a Comment